Washington State: Ranked 11th on State Business Tax Climate Index

Tuesday, October 28, 2014 at 2:10PM

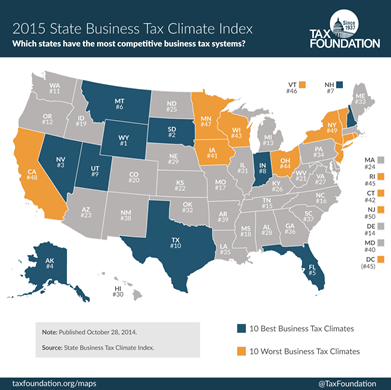

Tuesday, October 28, 2014 at 2:10PM The Tax Foundation has recently released its 2015 State Business Tax Climate Index. The full report can be found here.

Washington State ranked 11th overall on the index for best State Business Tax climate nationwide.

The purpose of the index is to enable "business leaders, government policymakers, and taxpayers to gauge how other states his tax systems compare."

In making its rankings, the Tax Foundation surveys each State's tax system comparing over 100 different variables in five areas of taxation (corporate, individual, sales, unemployment insurance and property). Then it compiles those results to create its final overall rankings.

However despite the fact that Washington scored well overall, it has one of the highest combined state and average local sales tax: at 8.88%.

Washington has the highest tax rate on spirits ($35.22 per gallon).

Looking at the corporate tax component alone, Washington ranked 28th.

Looking at the individual income tax component alone, Washington ranked 6th.

Looking at the sales tax component alone, Washington ranked 46th.

Looking at the property tax component alone, Washington ranked 23rd.

Looking at the unemployment insurance tax component alone, Washington ranked 19th.