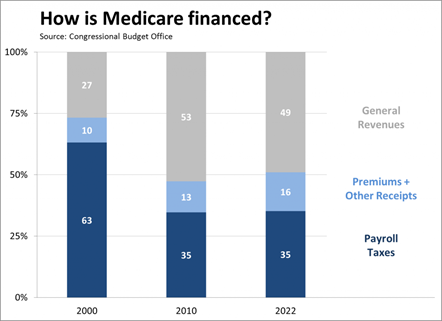

Payroll taxes only cover 35% of the costs of Medicare!

Wednesday, June 20, 2012 at 1:24PM

Wednesday, June 20, 2012 at 1:24PM The majority of the cost of Medicare is paid by general revenues of the federal government and not by taxpayers paying payroll taxes.

Donald Marron at the Tax Policy Center has recently posted a very interesting piece about the portion of 2010 Medicare costs paid for out of the payroll tax.

His key findings from the Congressional Budget Office 2010 data:

- Payroll taxes covered only 35% of Medicare costs in 2010.

- Payroll taxes covered more than 93% of Social Security's costs in 2010.

The balance of the Medicare cost is covered by user premiums (13%) and general federal revenues (53%).

Marron describes the difference between Social Security and Medicare:

"The difference between the two programs exists because payroll taxes finance almost all of Social Security, but only one part of Medicare, the Part A program for hospital insurance. Parts B and D (doctors and prescription drugs) don't get payroll revenues; instead, they are covered by premiums and general revenues. But that distinction often gets lost in public discussion of Medicare financing."

Very interesting stuff from the Tax Policy Center!