Tuesday

Feb052013

Washington’s sales, excise and gross receipts taxes

Tuesday, February 5, 2013 at 2:50PM

Tuesday, February 5, 2013 at 2:50PM

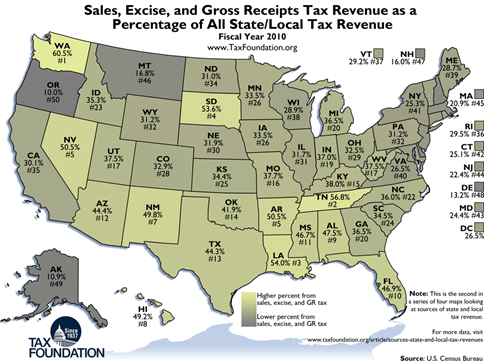

The Tax Foundation reports that Washington State has the highest proportion of its state and local tax revenues generated from sales, excise and gross receipts tax. Washington State generates 60.5% of its state and local tax revenues from sales, excise and gross receipts tax. The Tax Foundation's tax map with all other states is included below and can also be found here.

The balance of Washington State's state and local tax revenue comes from property taxes (31.5%) and other taxes (8.0%). Washington State has no individual income tax or corporate income tax per the Tax Foundation's report on The Sources of State and Local Tax Revenues.